What is going on with interest rates

The train has left the station from 2% now in the 4% range on mortgages and what is to come of it all?

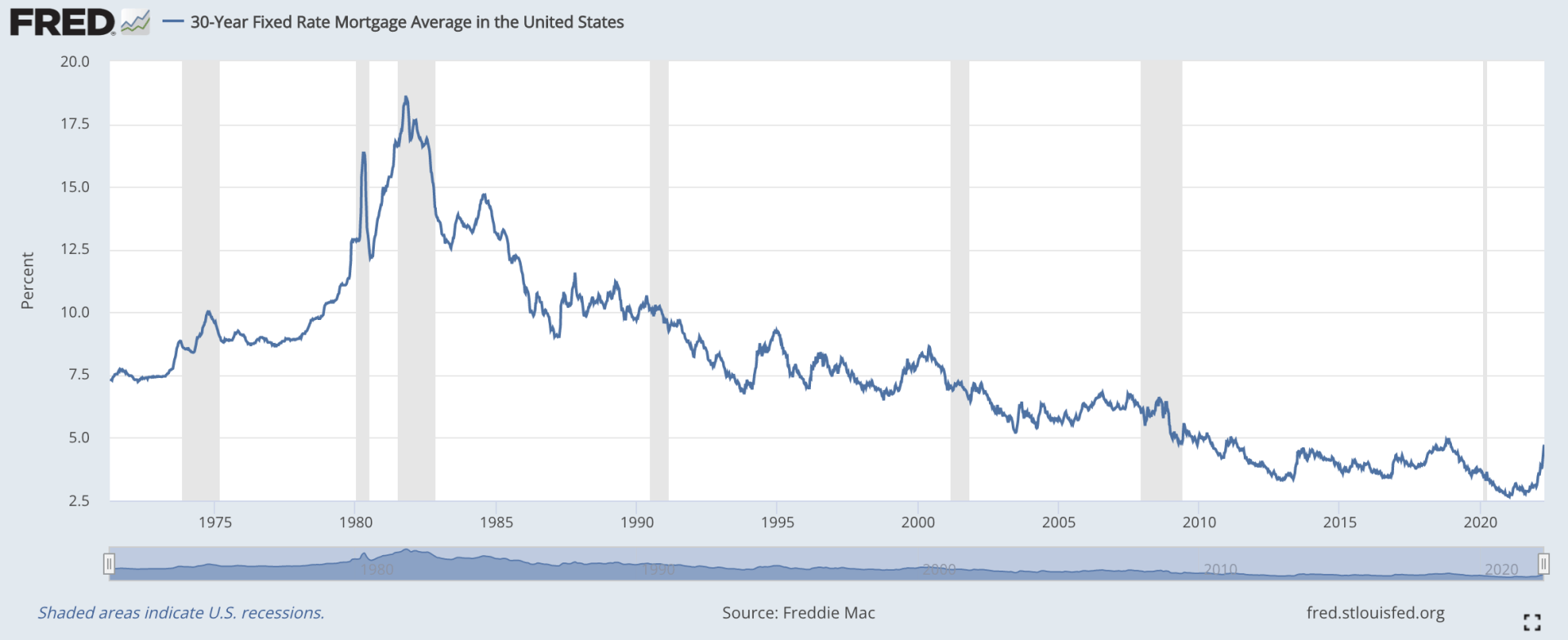

More than likely, they will continue to climb. The FED is likely to raise rates again in May and June. While it may feel like you’ve missed out, historically we are at pre pandemic rates and still much lower than pre-2008 levels (see chart below). Depending on what you are buying or refinancing, here’s what you need to know.

Does refinancing make sense?

This is a case by case scenario. If you purchased pre 2010 and have a rate over 5%, refinancing might make sense. If you have an adjustable rate that is rising, refinancing might make sense. Or, if you have credit card debt that is rising because of higher interest rates, cash-out refinancing might make sense. If you are just shopping for a lower rate, you are probably not going to want to refinance. If you give us about 30 minutes of your time, we can determine if refinancing with today’s rates makes sense. Give us a call, (727) 784-5555.

Does buying now make sense?

Absolutely. Rates are still relatively low (see chart above), and the cost of rent is raising faster than mortgage rates. The combination of building equity, increased property value, and no longer paying the landlord makes buying now more important than ever.

Future Opportunity.

Remember, when rates come back down, you can refinance. You are not stuck with your 30-year rate for 30 years. You can lock in a new rate whenever rates change again. There will be some closing costs associate with getting a new loan; however, there won’t be any out of pocket costs unless you choose to pay them.

What you can do?

The best thing you can do is know your options depending on your circumstances. Give us a call today, (727) 784-5555. We will run a financial evaluation for you based on your liabilities, expenses, and income. We can layout the financial pros and cons of buying, refinancing, or staying in your home.

Or complete our opportunity form below, and we will reach out to you.

Opportunity Form

Ask A Question

Start Your Loan

with DDA todayYour local Mortgage Broker

Mortgage Broker Largo See our Reviews

Looking for more details? Listen to our extended podcast!

Check out our other helpful videos to learn more about credit and residential mortgages.